Did you ever wonder how the money in your pocket or in the big jar of coins in you’re stockpiling in your room got there? Accumulated change for beer money is not the kind of answer I’m talking about. To really understand one of the main systems that pretty much rules your life you need to go deeper.

The Central Bank

Almost every country in the world has a Central Bank; this is a country’s National bank. In the USA this is known as the Federal Reserve or Fed. Its function is to provide financial and banking services to the country’s government and commercial banking system as well as implementing the government’s monetary policy and issuing currency. This is where money is created or “minted”.

Many central banks including the Fed are not government agencies but are set up like a private corporation. They do, however, work closely with the government and central bank leaders and are often government appointed. When a country wants money, the central bank either loans it via direct advances or by buying government securities or bonds in exchange for reserve notes. Government treasury bonds and securities are designated a value and the same value of federal reserve notes are traded for them. These Federal reserve notes are then deposited in a bank account. When the notes are deposited they become legal tender money. This then adds currency to the country’s money supply. This money is, however, owed back to the central bank, so the new money in the country is created by debt.

Fractional Reserve Banking

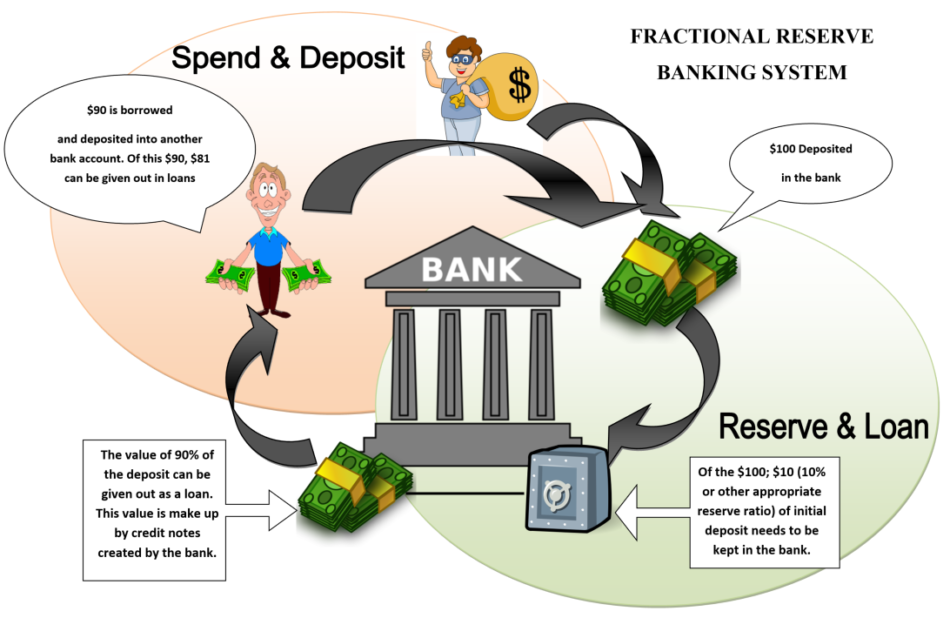

In most countries, banks work on a system called fractional reserve banking. This means that a bank needs to have a certain fraction (usually 10%) of the money they give out in loans held in reserve. So, if a bank has $100 in reserve they can loan out $90. This $90 is not taken directly from the $100 but instead is given out as a “Bank Credit” i.e. new money is created. This allows the pool of money in a country to expand. If the bank loaned out the $90 from the reserve it had, the amount of money in circulation would stay the same. This is possible because most money exists digitally (as a number on a screen). The amount of physical money in a country is a fraction of the total money supply in a country. When a person or business gets a loan from the bank, the bank accepts promissory notes (loan contracts), that the money loaned by the bank will be given back over a certain period along with interest for bank credits to the bank account of the person receiving the loan.

Generally, most or all of the money loaned out will also be deposited directly into another bank account, this adds to the reserve supply. So, taking the example of $100 in a fractional reserve system of 1:10, someone gets a loan for $90, then deposits this $90 in a bank account, this bank can then loan out $80, which is deposited to another bank account, that bank can then loan out $70 and so on. Again, the money put into general circulation is created out of debt, if there is no debt in a country there is no money. Another way of looking at it is; all the money in your pocket or in your jar of coins is owed to someone by someone.