The Origin of Gold as Money

Gold and other precious metals were used in commerce since the Bronze Age. However, the first gold coins were minted around the 5th or 6th century in Lybia Western Turkey. Gold is rare and so is a good store of wealth but it can be hard to carry around in large quantities, to alleviate this problem people began storing gold in vaults. The company running vault issued a receipt for the value of the gold given to them. These receipts were the origin of paper money and people could exchange these receipts directly for goods and services.

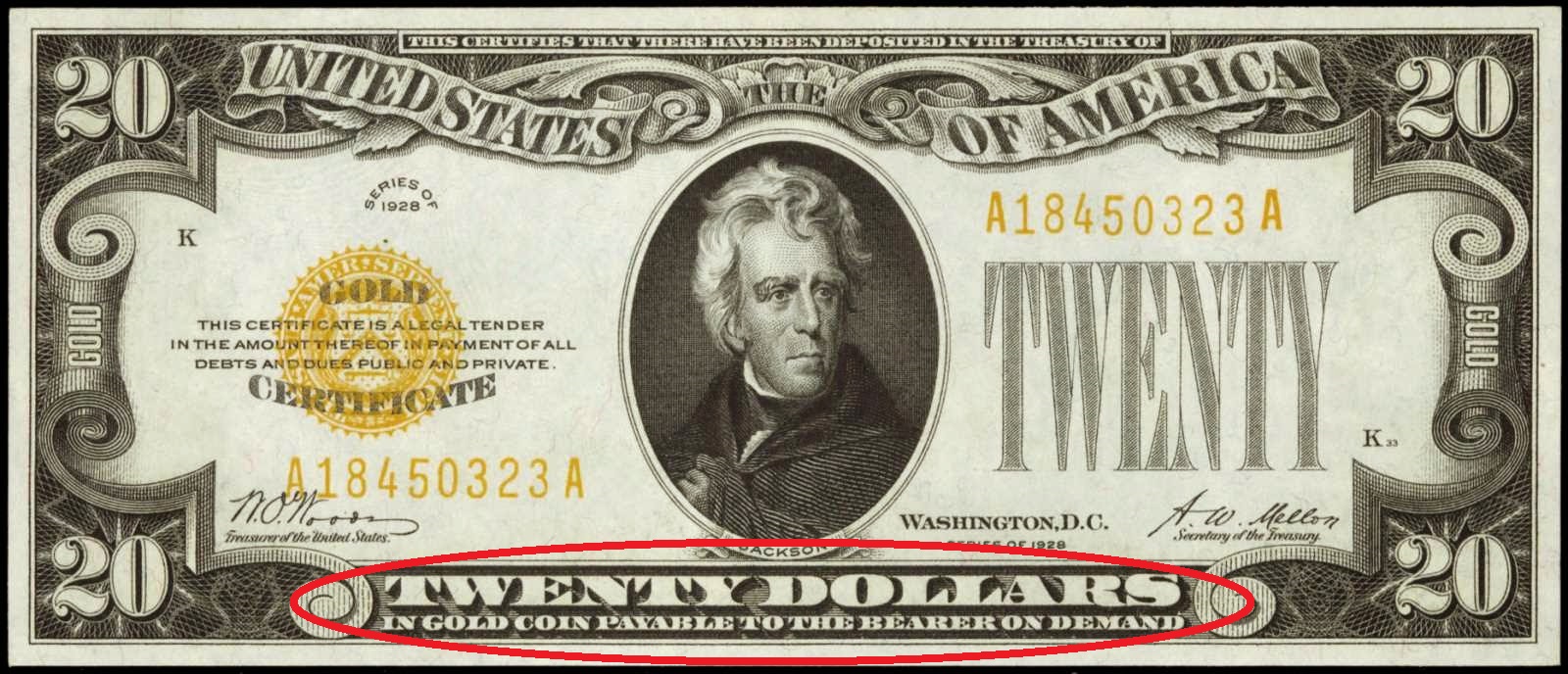

The Gold Standard

During most of the 19th and 20th century, most countries adopted a “gold standard” in which currency was pegged to physical gold. This meant people could go to the bank and exchange their currency for real gold. However, during World War II many countries spending increased dramatically to buy weapons and other supplies. The United States did not enter the war until quite late and their economy benefited greatly from supplying the Allies with weapons and other goods. A lot of this was paid for in Gold and so the United States then owned most of the worlds gold and the gold reserves of other countries depleted.

To deal with this imbalance, 730 delegates from 44 countries met in 1944 in Bretton Woods, New Hampshire to create the International Monetary Fund (IMF) and the “Bretton Woods Agreement”. Under the Bretton Woods Agreement, currencies were pegged to the US dollar at a certain rate of exchange and the dollar was pegged to gold at a rate of $35 per ounce. There was then, a fixed exchange rate between the dollar and other currencies and if the central bank of another country so wanted, they could exchange their currency for gold from USA. This was the beginning of the dollar as the world’s reserve currency.

Countries then began buying US treasuries in exchange for their dollars, thus increasing the flow of currency into The United States and their economy prospered. However, because of the economic burden of the Vietnam war, the US economy began deficit spending (spending in excess of revenue) with funds raised by borrowing rather than from taxation. So the US kept selling treasury bonds to other countries and flooded the market with dollars. This caused other countries, beginning with France, to become suspicious of the value of the dollar and so began asking for their money in gold. Now the US gold reserves were declining and in 1971 Richard Nixon removed the gold standard. Then world currencies became “fiat currencies”, this means they are not backed by anything physical and are valued based on supply and demand. With this system currency exchange rates are not fixed and so subject to inflation (oversupply and weakened buying power) and deflation (undersupply and increased buying power).